How To Calculate The Valuation Of A Startup: Five Credible Methods

28th August 2020

If you want to get investors to seriously consider backing your business, you need to understand how startup valuation works and provide them with a justifiable startup valuation. Understanding how to determine pre money valuation of a startup is crucial for early-stage businesses seeking investment. Many pitches fail because of wild valuations that infuriate and alienate potential backers, underscoring the importance of knowing how to calculate the valuation of a startup accurately. To calculate valuation of a startup, you must consider various methods and approaches tailored to your business’s current stage and industry.

An overblown startup valuation that can’t be substantiated will damage your credibility. Once you’ve lost the trust of your potential investors, they’ll likely move on to the next business opportunity. So, getting your valuation right from the start is vital if you want your Fundraising Journey to be successful.

DOWNLOAD: Business Startup Valuation Calculator

It’s easy to get carried away with the excitement and opportunities surrounding your idea. Understandably, you want investors to see the potential of this new venture. However, when you present them with the valuation of your business, it must be realistic. No investor is going to pay over the odds for equity in a startup when the figures don’t add up. They will demand to know how you arrived at your valuation and want to see solid assumptions of what they can expect in return.

A good pitch includes the winning combination of an inspiring vision full of potential, a clear strategy for commercial success and a justifiable valuation of the business right now. In the same way as you’d be cautious about giving too much equity away in early funding rounds, so too will your potential investors be concerned about stumping up more than they should for your shares.

Understanding how to determine pre-money valuation of a startup is crucial for early-stage businesses seeking investment. To calculate valuation of a startup, you must consider various methods and approaches tailored to your business’s current stage and industry.

Present them with a valuation that makes commercial sense, and you’ll put yourself in an excellent position to win their investment.

Five ways to value your business

There are five tried-and-tested methods you can use to value your business. Take a look at each one and decide which works best for you.

#1 The Berkus Method

Angel investor David Berkus’ infamous valuation method (updated in 2016 to reflect the changing landscape for investors) is well-respected among the investment community. The method he deploys is reserved for companies that have the potential to hit $20 million gross revenue (approx. £15.3 million) by year five of operation.

Early stage startup valuation often relies on methods like the Berkus Method and the Cost Approach to provide realistic figures to investors. Berkus has identified five components to make up the valuation, helping entrepreneurs understand how to determine the valuation of a startup and awarding companies a maximum of $500,000 (approx. £382,000) for each one.

- The startup idea is sound and has basic value with acceptable product risk.

- A prototype exists.

- The business has established or plans to establish a quality management team to reduce risks in execution.

- Strategic relationships to help the product sell and grow in the marketplace are already in place.

- Product rollout and sales plans exist (not applicable for pre-revenue startups)

A warning if you intend to use the Berkus Method – your view of the company is subjective and is likely to differ from that of an investor. Seek advice from investment experts outside your company to check your calculation and ensure it makes sense to them too.

Seek advice from investment experts outside your company to check how the startup valuation is calculated and ensure it makes sense to them too.

READ: What Is My Startup Valuation, And How Do I Justify It To Investors?

#2 Cost Approach

Pre-revenue businesses can benefit from an entirely cost-based valuation, one of the early stage startup valuation methods that shows how to calculate the valuation of a startup by adding up all costs. Learning how to valuate a startup involves comparing different business valuation methods for startups to find the most accurate assessment.

The Cost Approach is a valuation based simply on how much you’ve spent to build the business. Your figure should include everything that would be needed to rebuild the business from scratch, including your time. Typically, this valuation is lower than other methods because it does not include the valuation of the IP of the company or take into account future performance. However, it’s a useful approach for pre-revenue startups seeking early-stage investment in their Fundraising Journey.

#3 The Scorecard Method

In contrast to the Berkus Method, the Scorecard Method directly compares your business to other startups in your sector who are at a similar stage, showing another way how startup valuation works. Find out the average pre-money valuation for recent deals and use it to get your starting figure for valuation.

The main criteria (or risk factors) are as follows:

- Entrepreneur/team/board – 30%

- Size of opportunity – 25%

- Product/technology – 15%

- Sales/marketing – 10%

- Need for more financing – 5%

- Other – 5%

The benefit of the Scorecard Method is that it’s a straightforward and comprehensive approach to valuing your business. You’ll cover more ground than the Berkus Method, plus you can assign more importance to certain areas, instead of judging them all the same.

However, that flexibility can also be a weakness for entrepreneurs learning how to determine pre money valuation of a startup. When investors use the Scorecard Method, they know what risk factors they consider to be more significant than others, showcasing how to do startup valuation effectively. When you use the same methodology, you’ll be making an educated guess at what they will prioritise, and the two may not align.

#4 EBITDA Multiple

This valuation method is most often used at a scale-up or exit stage of the Fundraising Journey, helping founders understand how to do valuation of a startup during these phases. It’s an evidenced valuation based entirely on data you already hold. These are the data points used to calculate the EBITDA figure.

EBI – Earnings Before Interest

TD – Tax Depreciation

A – Amortisation

When you have your EBITDA figure, you need to find the right EBITDA Multiple for your sector (i.e. your industry’s benchmark) to calculate your Enterprise Value. You can find it by researching EBITDA Multiples for your sector and using your findings to discover the average multiple. Be careful not to confuse EBITDA Multiples with revenue multiples when you do this. Take a look at our article on EBITDA Multiples By Industry to get started.

When you have your EBITDA figure and the right EBITDA Multiple, you can use those figures to calculate your Enterprise Value. For entrepreneurs preparing an exit valuation, it’s a good approach as you can use your final EBITDA calculation in your forecasting, providing a clear method to calculate startup valuation. However, in the early stages of the Fundraising Journey, it can prove to be an inaccurate method for arriving at your current valuation. In the startup phase, your EBITDA is usually lower (or non-existent), so it may not provide an accurate valuation for what your burgeoning business is worth.

To resolve this issue, you could use your projected third year’s EBITDA as a basis for the valuation and then discount it to today’s value, taking into account the risks involved. In doing this, you can potentially appease investor concerns and ensure the valuation is fair given the early stage at which you are pitching. However, this does require further research to arrive at a realistic discount rate.

For investors, such robust data is reassuring as they have a clear picture of the current position your company is in and the growth journey you’ve taken (or plan to take). This approach allows them to consider whether the risks are outweighed by the projected performance your EBITDA Multiple predicts.

READ: Ebitda Multiples By Industry: Planning Your Exit Valuation

#5 Discounted Cashflow (DCF) Analysis

It’s important that we include DCF Analysis here, even though it’s less suitable for businesses in the early stages of their Fundraising Journey when using early stage startup valuation methods.

DCF Analysis is a sophisticated and data-driven approach, a basic explanation is that all future cash flows are estimated and discounted using the cost of capital to give their net present value. These calculations enable you to arrive at a valuation based on the projected money your business will make in the future, illustrating how startup valuation works.

For those in the startup phase, this method is unlikely to be useful as there’s simply not the required accuracy of data available as yet. However, it’s worth considering as you move into the Scale-up and Exit stages when you have significant cash flow data to analyse.

READ OUR COMPLETE GUIDE: How To Value A Business

Are you ready to do your startup valuation?

Hopefully, our introduction to these five business valuation methods for startups has given you a place to begin when calculating your business’s worth to investors, providing a clear understanding of how to determine a startup valuation. In a pitch situation, investors will invariably question your valuation, so being able to talk them through your process is vital. Even if they disagree with you, being able to demonstrate a solid approach on how to calculate the valuation of a startup is going to serve you well.

FIND OUT MORE: Data-Driven Business Valuation Service

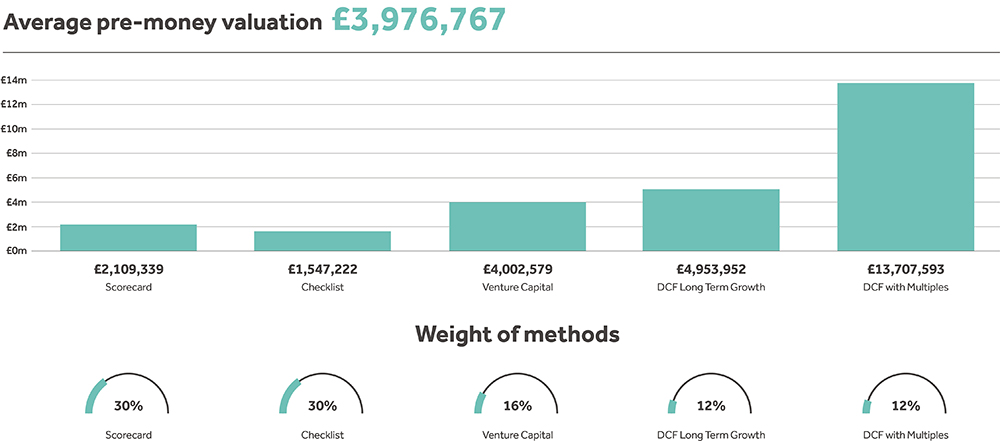

The very best way to calculate a robust valuation is to use a number of methods and input the valuations into a weighted scorecard. Valuations for the same company can vary massively depending upon the method used. When we create valuations for our clients as part of our PitchReady package we use five different approaches, including two different DFC methods and two scorecard methods.

We then create an average valuation from all five valuations calculated, giving each method a weighting based on its appropriateness to the company’s stage of the Fundraising Journey. For example, we’ll weight the valuation more towards the scorecard methods if it’s in the startup phase, and more towards the DFC methods if it is in the scale-up phases.

Note that with each method there is a massive variation in the value of this company. By using just one method the founder could have arrived at a valuation anywhere between £1.5m and £13.7m, and, technically, they would have been correct. This is how conflict over valuations between entrepreneurs and investors can occur, each using different methods of valuation causing large disparities between their expectations.

By using a weighted scorecard approach, you can arrive at a more robust a reasonable startup valuation that takes into account multiple methods as well as your current stage of the Fundraising Journey. It’s hard to argue.

Learn how to convince investors

Investable Entrepreneur takes you through our winning methodology – the process we use to increase our client’s chances of raising investment by more than 30x.

“This book will help you translate your entrepreneurial vision into something investors can get behind.”

Daniel Priestley, CEO and founder, Dent Global and four times best-selling business author

Keep up to date with what we’re up to via email

Copyright ©Robot Mascot Ltd. All rights reserved.