Protect Your Equity: The Smart Approach To Winning Early Stage Investment

23rd July 2020

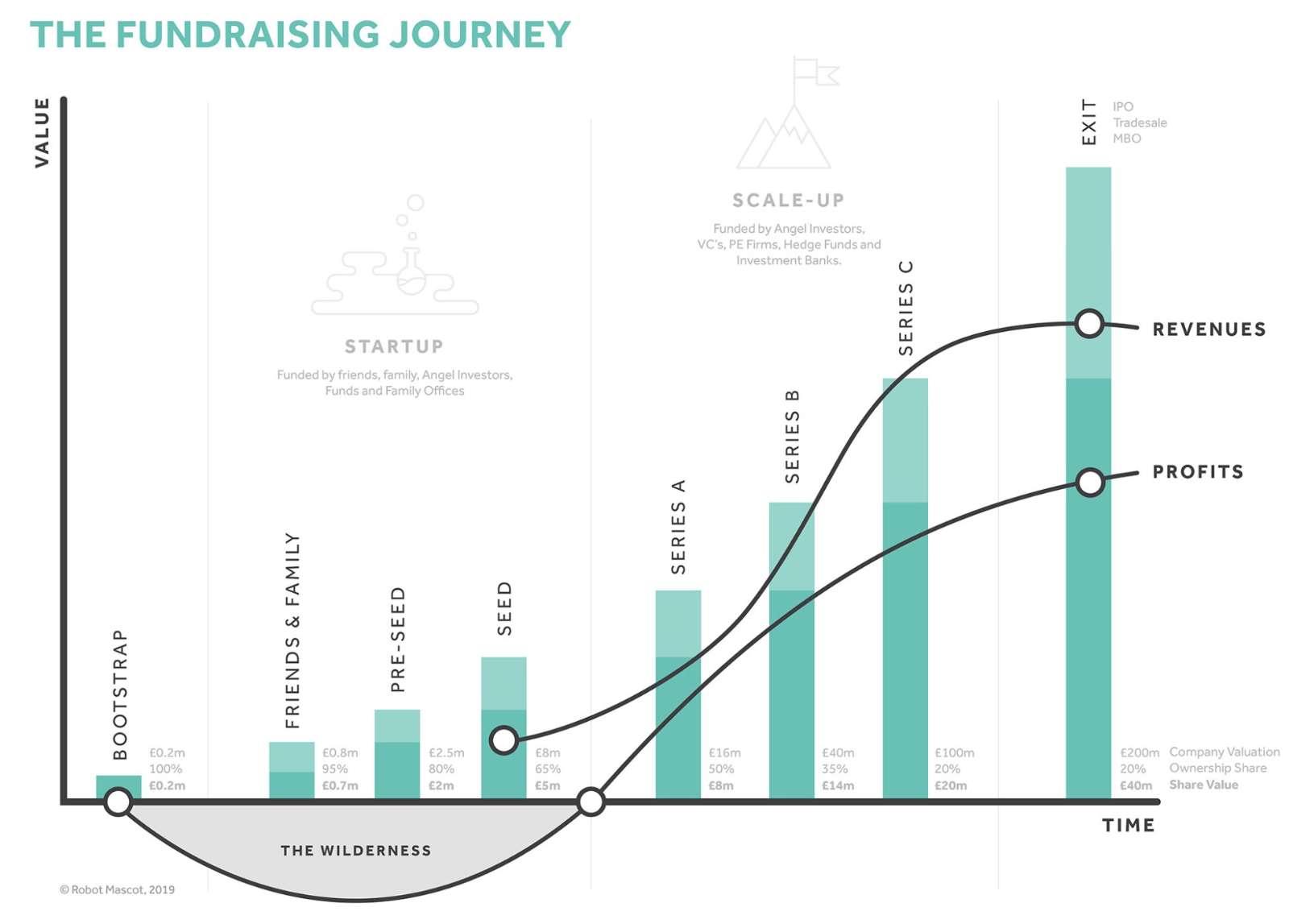

Taking your entrepreneurial idea from an exciting concept to multi-million-pound success story requires significant investment. There are four different phases of the Fundraising Journey – bootstrapping, start-up, scale-up and exit. In those first two early stages, you need to be astute about when to seek investment and the equity you offer in exchange.

Plenty of entrepreneurs are too narrow in their focus at the start of their Fundraising Journey. Instead of having a long-term strategy, they rush to secure funds and give away too much equity and control early on. This mistake comes back to haunt them later on when they exit the company without achieving their financial goals.

So, to ensure that your Fundraising Journey concludes successfully, you need to be smart in the early stages.

Phase 1: Bootstrapping

During the bootstrapping phase, you are likely to be funding the idea yourself. This first stage is defined by the time and money you inject into the concept to test and validate it. You may still be working elsewhere as a primary source of income while developing this new idea. Money is tight, time is precious, and everything is done on a shoestring.

Some entrepreneurs look for a co-founder at the bootstrapping stage – a partner who has a complementary skill set that will help evolve the idea. This can be particularly helpful if you need to build a basic prototype and don’t have the financial resources to pay for professional help. For example, a creative entrepreneur trying to launch an online platform would greatly benefit from partnering with a co-founder who has tech expertise.

It’s certainly not essential that you have a co-founder, as you may be perfectly capable of undertaking the bootstrapping phase alone. The main objective here is to move fast and get to the start-up phase. It’s unlikely you’d raise investment while bootstrapping, and it’s unwise to try. Instead, work quickly to reach the start-up phase and better investment opportunities.

Phase 2: Start-up

Once you are at the start-up phase, it’s time to explore investment opportunities. The work you have done so far gives you a foundation to build the case for commercial viability. As a start-up, you must prove there’s a consumer appetite for your product or service, identify the right revenue model and build your audience. Everything you are doing is geared towards making the product or service ‘market-ready’.

If you split your investment into two or three rounds you can raise more money in return for less equity. By hitting key strategic milestones in between rounds, you can increase your company valuation each time. This will allow you to raise more investment in return for less equity over the longer term.

Round 1: The Friends and Family Round

At this stage, there’s a specific group of potential investors you should target – people who know and believe in you. Investment at this stage is high-risk, so the first round of your Fundraising Journey typically involves people with a personal connection to the founders. During this round, you may be pitching to people with limited experience of either investment or the industry you’re in, and who only have a modest amount of money to offer. However, they are personally invested in empowering you to prove your concept and get it to the point where you can take it to investors who don’t know you.

During the Friends and Family round, you would typically seek no more than £50k of investment and only part with between 5% – 10% of equity to secure the funding. With many rounds ahead of you on the Fundraising Journey, it’s a mistake to part with any more equity than that.

Hopefully, this round of investment will carry you onto the next stage – and that’s where the investment numbers get more serious.

Round 2: The Pre-Seed Round

Some Angel Investors like to swoop in to fund start-ups before they begin generating revenue (in doing so they can secure more equity for their money as the business is at a lower valuation). During the Pre-Seed Round, you should take every opportunity to pitch to those people, showcasing your proof of concept. The investment remains high-risk, but with Angel Investment, you can create your MVP (Minimum Viable Product) [link to MVP article], test it and further establish the product/market fit.

As high-net-worth individuals, these investors may be willing to give you between £100k – £500k at the Pre-Seed stage. In return, you should be prepared to provide them with around 15% in equity. Don’t be tempted to skip ahead and miss out the next Seed Round by parting with more equity in return for slightly higher investment now. This won’t serve your long-term goals of retaining as much equity as possible. Instead, use the Pre-Seed investment to get your product or service to a soft launch stage and to bring in paying customers.

Round 3: The Seed Round

By now, you are most likely to have paying customers or active users and more proof that your idea has traction. At the Seed Round, the investment you seek will be more significant, typically between £500k – £2m. However, the amount of equity you offer in return should remain at around 15%. Although the business remains at an early stage, for now, it’s heading towards the scale-up phase and may already be valued at between £3m – £10m. You shouldn’t part with more equity than necessary.

Now is the time to approach Angel Investors, Angel Groups, Venture Capitalists, Family Offices or Crowdfunding Platforms to win Seed investment. During the pitch, you should outline how you’d use this funding to develop scalable marketing strategies, recruit your core team and create systems to cope with scaling up a business. The offer you are presenting still carries risk, but there’s plenty of evidence there that this is an investment that is likely to pay off. From here on out, it’s all about how you grow the business.

Once you’ve secured those first three rounds of funding, you will move into the scale-up phase. To arrive at that stage knowing that you still hold the majority of equity in your business is reassuring. It means that you are on course to a successful exit in the future. Now, all you have to do is grow your business, develop valuable assets and make a massive impact in your industry. It might sound like a daunting prospect, but you’ll have much more confidence if you’ve navigated the early stages of your Fundraising Journey successfully.

Keep up to date with what we’re up to via email

Copyright ©Robot Mascot Ltd. All rights reserved.