Startup Business Plans: The 3 Cs you need to create the perfect plan.

7th January 2021

Handing your business plan to an investor for the first time is a nerve-wracking experience. Contained in its pages is the information that could make or break an investment opportunity. It can be the difference between your investor backing you, or your offer being consigned to their ‘never going to happen’ pile. So, you need to make sure that your business plan is doing everything you need it to.

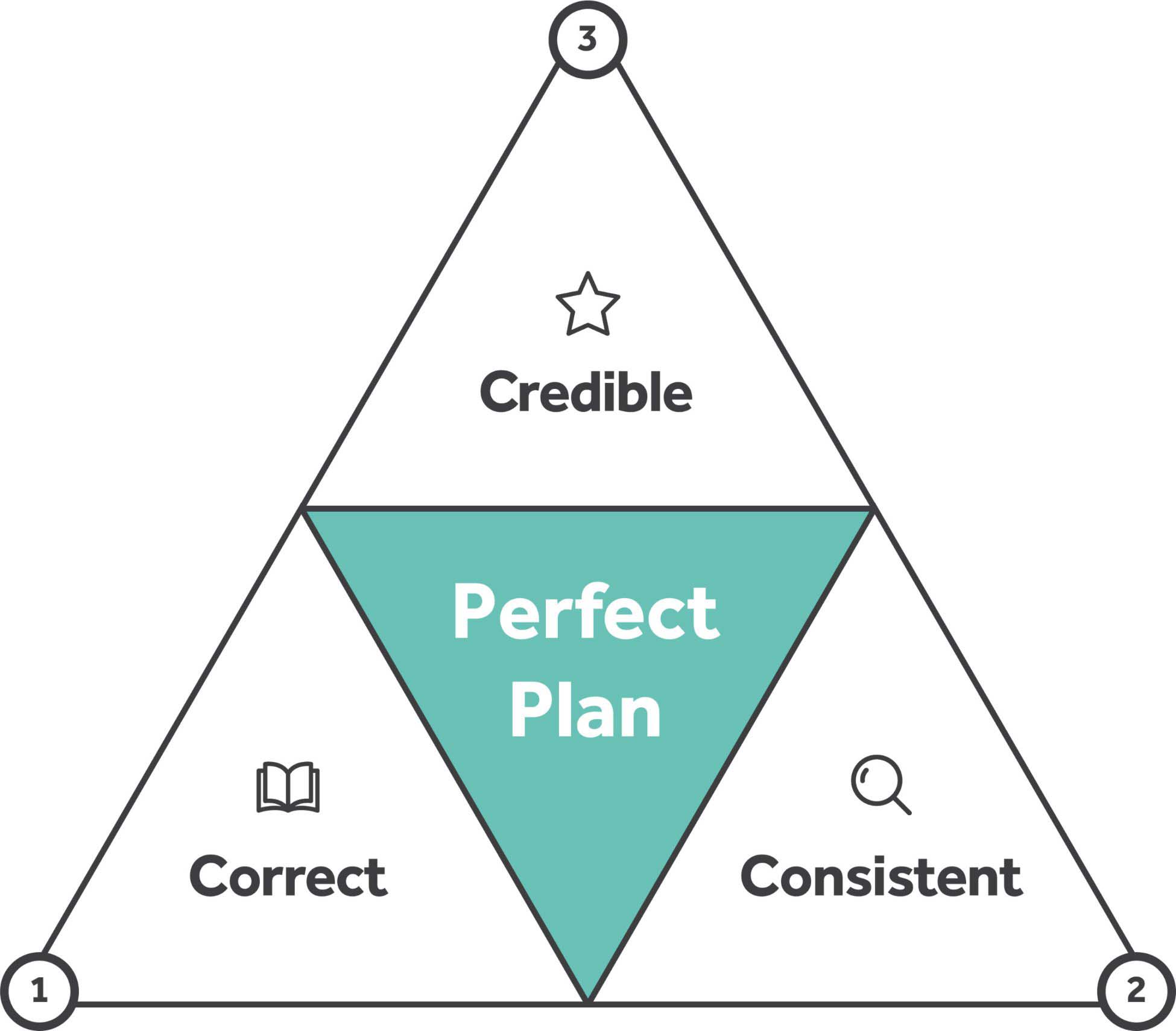

That’s where the ‘3 Cs of the Perfect Plan’ come into play. When we work with entrepreneurs, we’re laser-focused on the 3 Cs because if you get them right, your business plan will impress investors. Of course, plenty of people get them wrong, and that’s when their investment opportunities crumble to nothing. You don’t want to miss out because you didn’t use the 3 Cs as a guide to creating a perfect business plan.

Be Correct: Avoid Missing Content

Put yourself in the shoes of your potential investor. You’ve put a business opportunity in front of them, and now they are looking for all the information they require to make a decision. To achieve the first C of being Correct, you need to make sure that inside your business plan are all the facts and figures that your potential investor needs to make their decision.

Compare it to the significant investments in life, for example, buying a house. When you buy a house, you want to know as much as possible about the building, its features, exactly what land you are purchasing, any problems that you might encounter and many other essential details. You wouldn’t sit down for a coffee with the current owner, hear them explain what a great house it is and just buy it off them there and then.

The detail and information in your business plan should be collated after you’ve thought through exactly what your investor will want to know. You need to get into their mindset and satisfy the questions they’re bound to ask. Yes, they’ll want to know all about your fantastic product or service, the processes and staff you’ll need, but there’s more to include. Think about the operation of your core business functions, market analysis, competitor research, product validation, your customer acquisition strategy and your day of exit scenario plan too.

By providing this detail without the investor having to ask for it, you’ll prove you’ve been thorough and taken care to be correct. Missing content will only frustrate and potentially alienate the very people you are trying to win over.

Be Consistent: Avoid Mismatching Content

There’s a good chance that your business plan will be a work in progress for several weeks or months. As such, things might change along the way as you tweak and add information. Evolving the plan is a good thing unless the stuff you are adding doesn’t make sense alongside your original content. We cannot stress how vital it is to check your business plan and make sure it satisfies the second of the 3 Cs – Consistency.

Many entrepreneurs come unstuck due to inconsistent information in their business plans. Once you’ve put in everything you want to, you need to go back and check every part of the plan for consistency. Every piece of information needs to match up, something that can be a challenge if different team members have worked on different parts of the content in isolation. Perhaps something significantly changed in one area, and you hadn’t noticed the impact it had on another part of the plan. Check, double-check and then check again.

Investors will be less than impressed with inconsistency. They will check that everything matches up as they expect it to. Just as you would when you are on the first visit to a house you might be interested in buying. Say the advert said the property came with a big garden and conservatory, but when you arrived the pictures were woefully misleading. Perhaps the garden is several square-foot smaller than the advert stated, or the conservatory has a big hole in the roof. The inconsistencies between the original ad and your viewing would likely result in your striking it from your list. Don’t let investors do the same thing to your business opportunity because you failed to be consistent.

Be Credible: Avoid Unrealistic Content

If you are in an early stage of The Fundraising Journey, you will be presenting investors with claims about the potential of this investment opportunity. You are unlikely to have facts and figures that prove anything, so the business plan can only achieve credibility if you can back up those claims by showing how you sensibly arrived at them.

The temptation to exaggerate is huge, the desire to focus purely on evidence that backs up your beliefs is hard to resist, but this spells disaster. You need to present to your investors a compelling and evidence-based case for why they should invest in your business. It must be the definition of the third of the 3 Cs – it must be credible.

Say you are a property developer, and you are viewing a house that needs significant work to be brought up to standard. The estate agent tells you that if you invested £100,000 in the work, you could quadruple the value of the property and sell it on. So far, so good. But when you went away and did some research, you discovered that the ceiling value for properties in that street or area was far below that projected price and that the best you could hope for would be a much smaller figure. What the estate agent presented to you was therefore wildly unrealistic, and you would no longer consider them credible.

The same pitfalls await the overzealous entrepreneur who presents a business plan packed with overly optimistic figures. If you want your plan to hold up to investor scrutiny, you need to take a different approach. Make sure that every claim you make can be backed up by primary and secondary research, explain clearly how you’ve arrived at every assumption and use thoroughly-interrogated data and market insights to strengthen your case.

The moment you sit down with an investor, you need both you and your business plan to be equally credible if you want them to back you. If you are ready with everything you need to support your pitch, your chances of winning investment significantly increase.

Learn how to convince investors

Investable Entrepreneur takes you through our winning methodology – the process we use to increase our client’s chances of raising investment by more than 30x.

“This book will help you translate your entrepreneurial vision into something investors can get behind.”

Daniel Priestley, CEO and founder, Dent Global and four times best-selling business author

Keep up to date with what we’re up to via email

Copyright ©Robot Mascot Ltd. All rights reserved.