Equity Investment Market Update: H1 2020

16th July 2020

You may be hearing news today painting a gloomy picture of the investment landscape following the launch of the Beauhurst first-half report for 2020. But things are not as bad as the clickbait headlines would have you believe. At Robot Mascot, we thought we would dig through the numbers and give you the context you need.

The Headline:

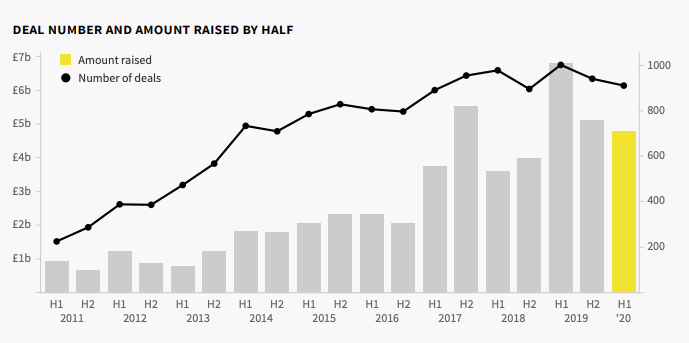

The amount raised in H1 2020 totalled £4.77b — a 7% decrease from the previous period and a 30% drop from H1 2019.

The Context:

When you actually look at this in a wider context of time you’ll see that deal numbers have been static and fluctuating slightly since 2017. H1 2020 was actually a better time to be raising investment than H2 2018 and any time previous to 2017.

The Headline:

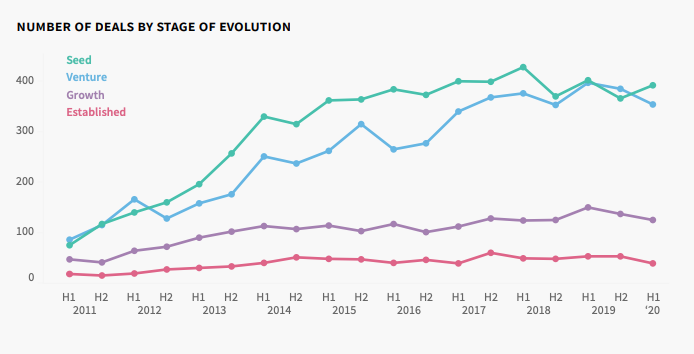

First-time fundraising has taken a nose-dive, with a 15% fall from H2 2019. This shows that early-stage investors have focussed their resources on existing portfolio companies.

The Context:

This is very true. But remember “first-time funding” doesn’t mean seed funding. It’s simply the first time a company has declared a raise. Some companies raise their first funds as a Series A round, many raise their first funds as a Freinds and Family round. Seed-stage deals are actually the only deals to increase in H1, by 7%, while venture and growth fell (but again not a low as H2 2018 levels).

The Headline:

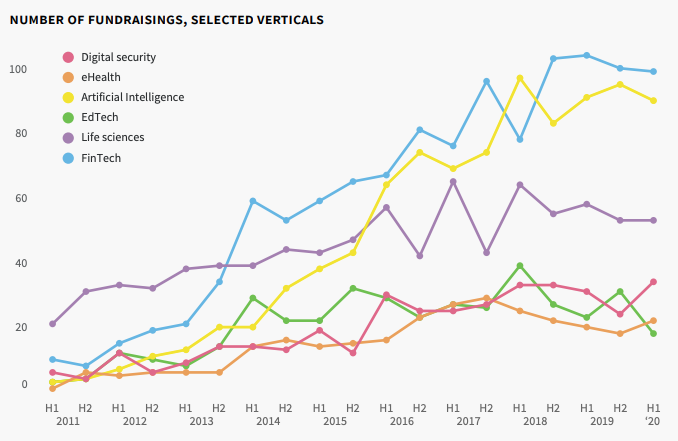

Most sectors experienced a decline in deal numbers, including investor favourites fintech and artificial intelligence. But digital security and eHealth startups have thrived through lockdown.

The Context:

FinTech deals remain strong, with deals higher than at any point pre-2018. The same is true for artificial intelligence. It’s the best time ever to be in digital security with deals at their highest point ever. Health Tech has seen a slight increase, following a pretty sustained fall since H2 2017. Perhaps this is a signal of a recovery that verticle. Surprisingly, things don’t look good for EdTech with deals at their lowest since 2013.

The truth is, that the market remains pretty buoyant considering all the panic and change it’s had to deal with. Investment levels remain pretty consistent in the wider context of the past few years, where we’ve been seeing a general stagnation on the kind of growth we experienced between 2011 and 2016. There is absolutely no reason to panic so long as you keep doing the right things, and position yourself as an investable entrepreneur

Keep up to date with what we’re up to via email

Copyright ©Robot Mascot Ltd. All rights reserved.